VOLUME ON AI LTP CALCULATOR

Volume and Open Interest are another important terms mentioned on the AI LTP Calculator or any other option chain. These two are the main factors in deciding support and resistance on the AI LTP Calculator. In this chapter, we will discuss about the Volume on AI LTP Calculator or any other option chain.

Lesson Highlights

What is Volume ?

Before the LTP Calculator, most options traders and stock market trainers who claimed to be experts in option chain data analysis were not even discussing the role of volume on the option chain. According to them, volume had no role in forming support and resistance in the stock market; they focused only on Open Interest. Volume was not considered important at all.

However, apart from all these experts, there was one person who conducted his own research on the option chain and discovered that volume is as important as Open Interest in forming support and resistance levels in the market. In fact, according to him, volume is more reliable than Open Interest. That person was none other than our mentor, Dr. Vinay Prakash Tiwari.

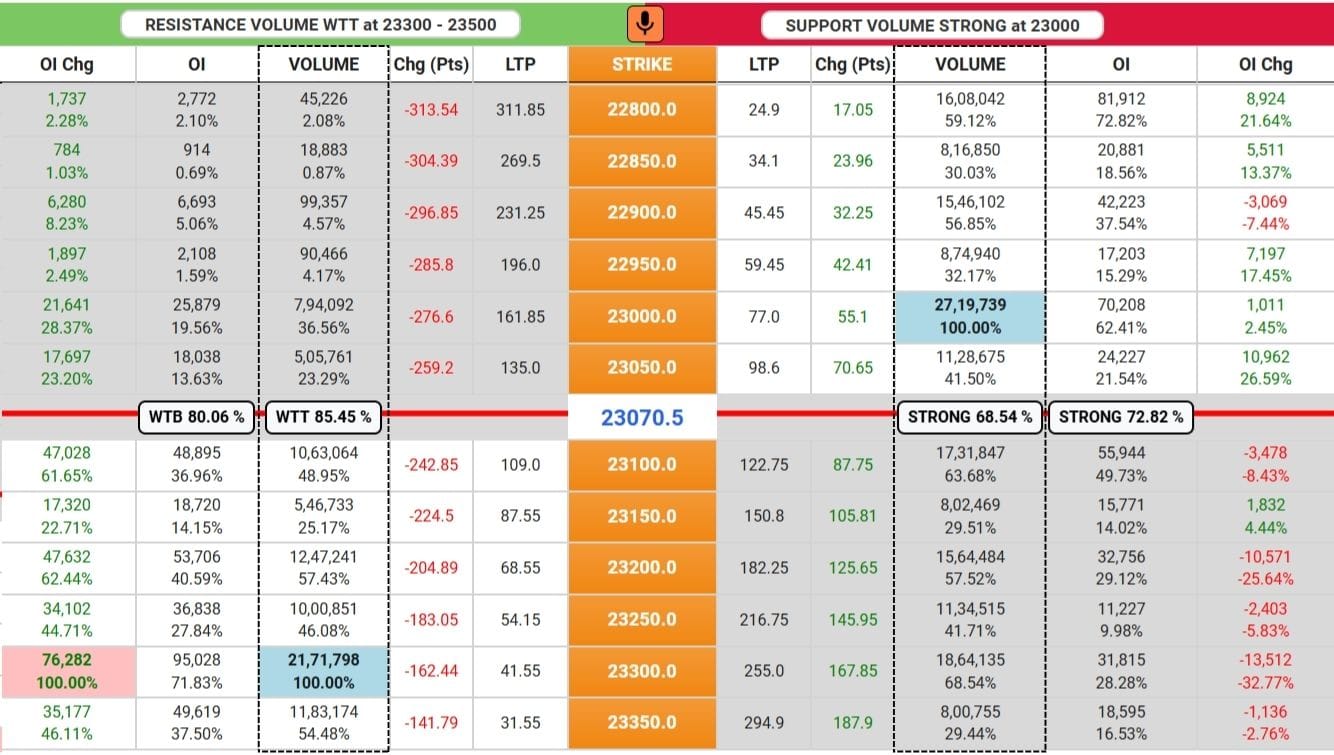

In the above image of the AI LTP Calculator, you can see the Volume column. Volume can be represented in quantity or in lots. On the LTP Calculator, volume is represented in contracts (lots), while on the NSE official website, volume is represented in shares (quantity).

Buying and selling together make a trade. This means if you have placed your buying order on the broker’s panel and your order has not been executed, then the trade has not happened. When a seller is found at your rate, then your order gets executed and you make a trade. The total number of shares or contracts traded is called volume. In simple words, number of lots or shares changing hands, no matter whose hands, as shares change hands volume increases. Every buying or selling increases the volume.

- On the option chain, Volume is created by open interest.

- Buying and selling together make a trade. If a seller is willing to sell 1000 lots but only 500 lots are bought, then the volume will increase by 500 because only 500 lots have been executed in the trade.

- Volume is intraday data and never decreases; it can only increase with every trade, whether it is buying or selling.

- Volume resets to zero every day and keep on increasing with every trade. This feature make it trustworthy for traders.

- If somewhere volume is written in lots then to convert it into quantity you just find the lot size of that stock or index and multiply that lot size with written lots.

Conclusion

In this chapter of the LTP Calculator free course, we came to know about the volume on the option chain and its features. My motive with this chapter was to teach you that open interest is not the only key player on the option chain; volume is also as important as open interest, and in fact, in our trading journey with the LTP Calculator, it will prove to be more reliable and trustworthy in comparison to open interest.

So, keep learning the stock market with LTP Calculator, and believe me, one day you’ll also say, It’s a Baccho ka Khel.