STRIKE PRICE ON AI LTP CALCULATOR

In this course, we are learning about the option chain. But can you think—what is the base of the option chain? What is the thing that, if not available on the option chain, would make it just a random number? In this chapter, we will learn about these bases of the option chain. Yes, you are correct—we are going to learn about the strike prices and LTP on the option chain. Let’s understand the concepts of strike price, LTP, and the imaginary line.

Lesson Highlights

Strike Price

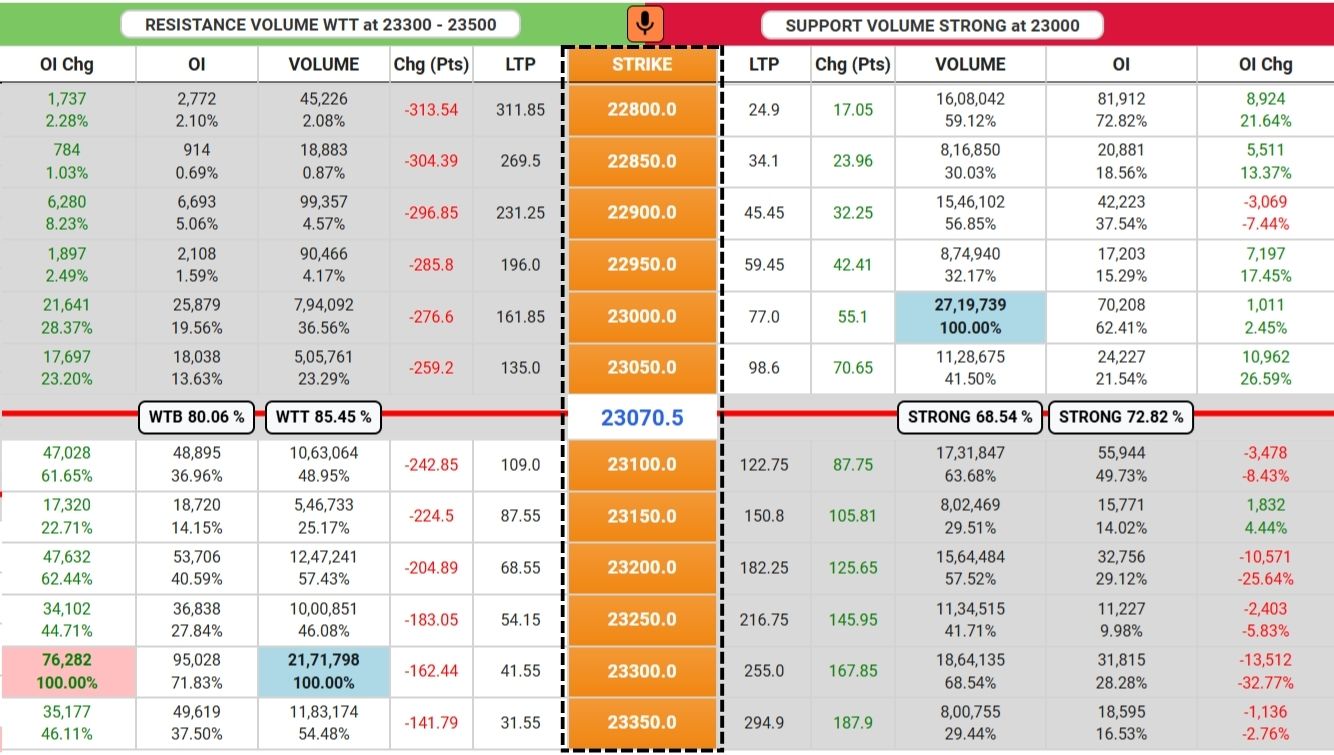

On the LTP Calculator, there is a column in the middle of the option chain that contains numbers and divides the option chain into two parts: LHS and RHS. The number in that column is called the strike price. The LHS contains data for the call side, while the RHS contains data for the put side.

In the above image you can see the strike price column. The strike price acts as the base in options trading. When a trader wants to buy/sell call or put options, they must first decide the strike price at which they want to trade.

For example, if Person A wants to buy a call or put option, they will look for something like 24500 CE or 24500 PE. The number (24500) represents the strike price, and the suffix (CE or PE) indicates whether it is a call or put option.

Imaginary Line

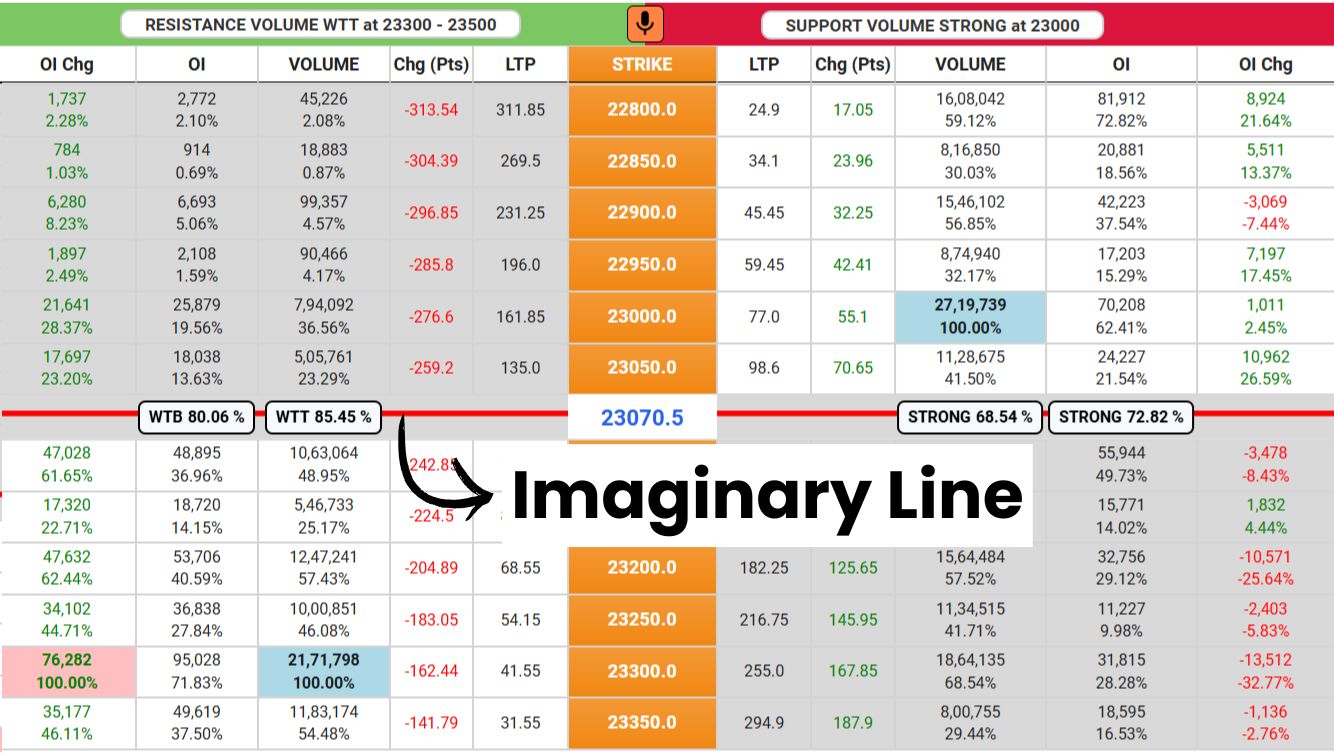

On the AI LTP Calculator option chain, you will also have the current market price. This current market price is not written separately as in other option chains; instead, it is shown in the middle of the option chain, along with a line drawn between the strike prices where the current market lies, and that line is called the Imaginary Line on the AI LTP Calculator.

In the above image, you can see the imaginary line. On this imaginary line, you will also see the status of support and resistance written as WTB, WTT, and Strong. Along with the status, the second-highest percentage is also shown there. We will learn more about this in upcoming chapters.

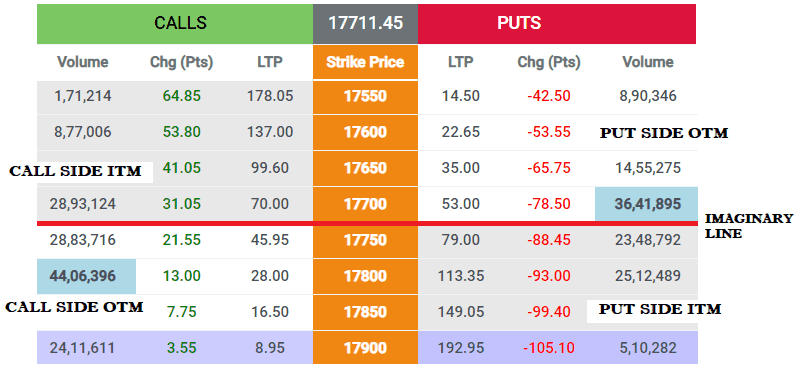

This imaginary line further divides the option chain into two parts—Top and Bottom. If you remember, the strike price has already divided the option chain into LHS and RHS. Finally, the option chain is divided into four parts. Now, look at the option chain image—you will notice that it has two colors: white and grey. What does that mean? Let’s understand this.

Last Traded Price

Last Traded Price (LTP) refers to the price at which a particular stock, index, or asset was last traded. In options trading, LTP is the premium that a buyer pays to the seller to get into the agreement.

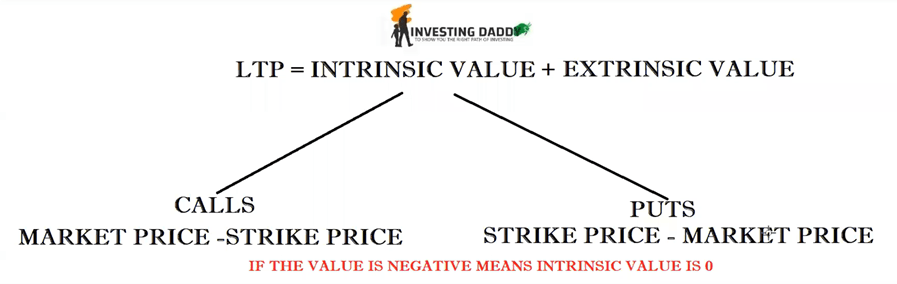

Each strike price has its own LTP. The LTP of every strike price differs from one another. Even the LTPs of the same strike price, i.e., Call LTP and Put LTP, are not the same. Why does this happen? The key reason behind this lies in the Intrinsic and Extrinsic Value. LTP is made up of two components: Intrinsic Value and Extrinsic Value. This Intrinsic value and Extrinsic value are the reason for white and grey color on option chain. Let’s understand this.

Intrinsic Value in LTP

Intrinsic value in LTP refers to the actual worth of the premium based on the strike price to which the LTP belongs and the current market price of that particular stock or index. Intrinsic value fluctuates as the market price changes. Not every strike price’s LTP has intrinsic value. The strike prices whose LTP has intrinsic value are shown in grey, while those with no intrinsic value are shown in white.

Now, the question is: which strike prices have intrinsic value? The answer is different for the call and put sides. Intrinsic value cannot be negative; the minimum possible value is zero.

On the call side, the strike prices that are lower than the current market price have intrinsic value. For example, in the above image, we can see that the current market price is 23,070, and all strike prices below 23,070—such as 23,050, 23,000, 22,950, and so on—on the call side have intrinsic value.

INTRINSIC VALUE IN CALL SIDE = CMP – STRIKE PRICE

On the put side, the strike prices that are higher than the current market price have intrinsic value. For example, in the above image, we can see that the current market price is 23,070, and all strike prices above 23,070—such as 23,100, 23,150, 23,200, and so on—on the put side have intrinsic value.

INTRINSIC VALUE IN PUT SIDE = STRIKE PRICE – CMP

Extrinsic Value in LTP

Extrinsic Value in LTP reflects the time value of the premium. Every strike price has extrinsic value. The strike price that doesn’t have intrinsic value has only time value. This value gradually decreases over time, and when the contract expires, it reaches zero. At that point, the LTP has only intrinsic value. If the intrinsic value is zero, then the LTP will be zero at expiry.

EXTRINSIC VALUE IN CALL/PUT = LTP – INTRINSIC VALUE

Now, the question is: can this extrinsic value decrease only, or can it increase as well? The answer is yes, it can also increase over time or even suddenly. This happens due to news events in the market, like the Hindenburg report, or planned events like the RBI policy announcement or the budget. These factors affect the extrinsic value of the premium. It can keep increasing until the event occurs, or it may experience a sudden increase due to sudden news.

On the option chain, you can clearly see the effects of news and planned events on the premium. Implied Volatility (IV) plays a key role in this. If you start regular trading in a stock or index, you will become familiar with the normal IV for that stock or index. However, when news hits the market, this IV will become abnormal. You will automatically understand the situation.

OTM, ATM and ITM

Now, we have learned about intrinsic and extrinsic value in LTP, so understanding OTM, ATM, and ITM strike prices will become easier for us. Before moving ahead, first understand that OTM, ATM, and ITM are used to refer to strike prices; they are not used for referring to LTP.

In the Money (ITM) – ITM refers to those strike prices that have intrinsic value. On the option chain, ITM strike prices and their data are highlighted in grey on both the call and put sides. These are favorable for option buyers. Option buyers should always prefer ITM strike prices, especially those with higher volume and higher delta (above 0.6).

At the Money (ATM) – ATM refers to those strike prices that are closest to the current market price. LTP of ATM strike prices have the highest time value. These are favorable for aggressive writers who want to earn maximum profit.

Out of the Money (OTM) – OTM refers to those strike prices that have only extrinsic value. LTP of OTM strike prices have no intrinsic value. These are favorable for writers because of the lower delta and lack of intrinsic value.

Conclusion

In this chapter of the LTP Calculator free course, we learned multiple concepts related to strike prices and LTP. My motive with this chapter was to teach the importance of the imaginary line and strike price, as well as the concepts of LTP, intrinsic and extrinsic value and ITM, OTM, and ATM on the option chain.

So, keep learning the stock market with LTP Calculator, and believe me, one day you’ll also say, It’s a Baccho ka Khel.