GREEKS ON AI LTP CALCULATOR

From this chapter on Greeks on AI LTP Calculator, we are going to understand the option chain and the terms mentioned on it. On the LTP Calculator, or any other paid option chain, you will find the Greeks—Delta, Vega, Gamma, and Theta. These four Greeks are important for options trading, whether it is option buying or option selling. Let’s start learning about these Greeks.

Lesson Highlights

Birth of option Greeks

Before moving ahead, I am assuming that you have basic knowledge of Futures and Options, and you are aware that there is always a difference between the futures price and the spot price of any particular stock or index. This difference keeps changing with every tick in the market. It can increase or decrease depending on market sentiments.

Generally, the futures price is higher than the spot price, but sometimes, due to market volatility or sentiment, the futures price may be lower than the spot price. Gradually, as days pass and expiry comes closer, this difference also decreases, and on the day of expiry, both prices become equal by the end of the session.

Due to that difference between the futures and spot price, major and minor Greeks come into existence. Delta, Theta, Vega, Gamma, and Rho are the major Greeks, and the collective movement of these Greeks is reflected in the Implied Volatility (IV).

Greeks on AI LTP Calculator

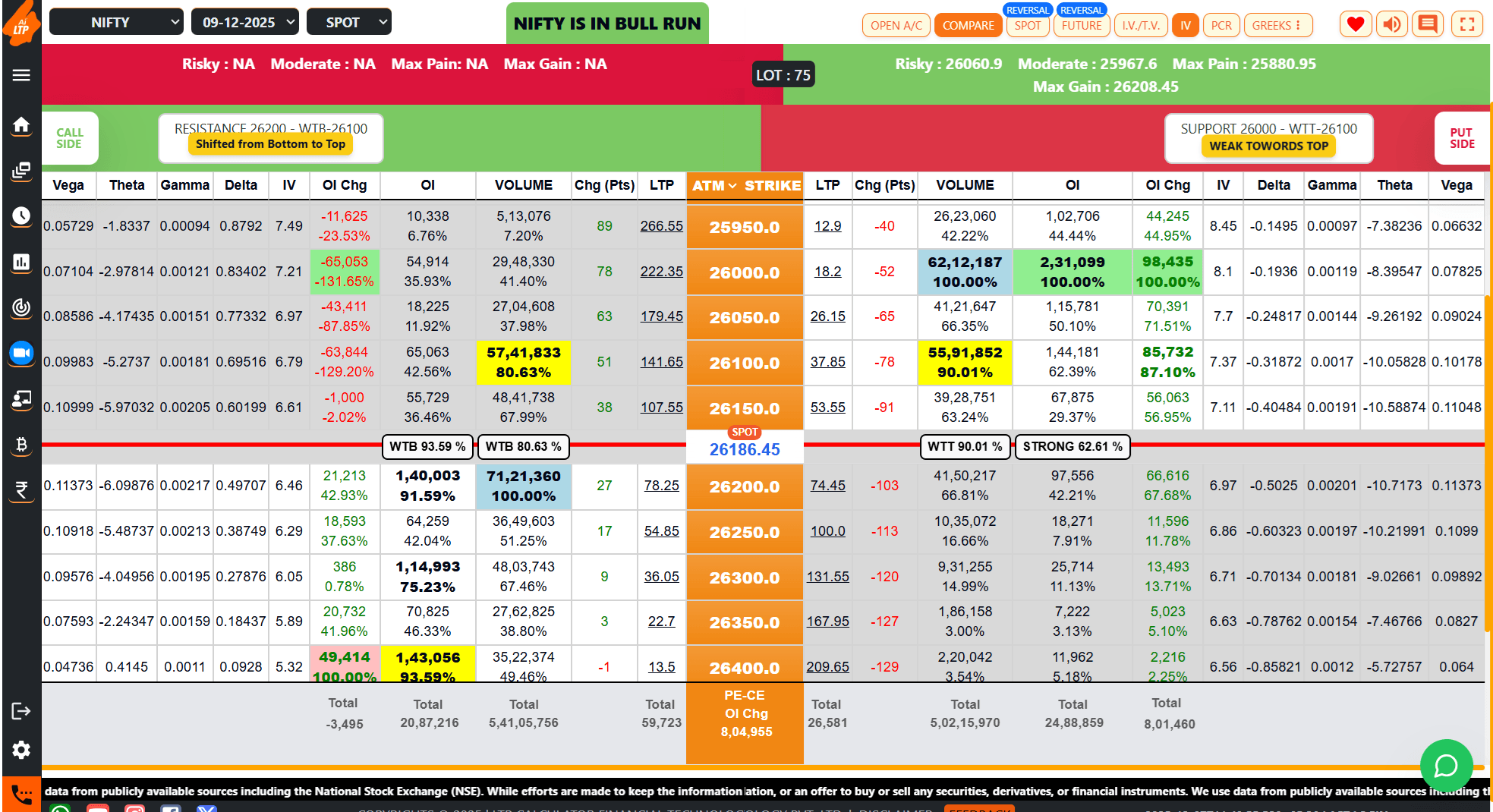

On the AI LTP Calculator, you will see four major Greeks—Delta, Theta, Gamma, and Vega. Apart from the Greeks, IV is also available. Every option contract has its own Greeks and IV.

You might be thinking that one strike price means one contract, but that is incorrect. One strike price has two contracts: Call side and Put side. And actually, even saying two is not fully accurate. Futures and Options contracts exist for three months, and if there is a monthly expiry, then 2 × 3 = 6 contracts exist at the same strike price. If weekly expiries are available, then the number of contracts will be even higher for a single strike price, depending on the stock or index volume and volatility.

When you trade in options, whether you are buying or selling — your profit or loss (even if the market moves in your desired direction) depends entirely on the Greeks of the option contract you have traded. That is why it is important to understand the role of Greeks in options trading before you start trading.

In the above image of the AI LTP Calculator, all four major Greeks—Vega, Theta, Gamma, Delta—and IV are available. Let’s understand the role of each of these Greeks:

Vega: It describes the volatility of a particular strike price. Vega indicates how much the option’s price will change for a 1% change in implied volatility.

Theta: Commonly referred to as the time value of the premium (LTP). It represents the rate at which the premium (LTP) decreases or depreciates as time passes. Assuming there is no movement in the market price—in other words, if the opening and closing prices of the day are the same and other factors remain stable—the option’s price will decrease by an amount equal to Theta at the end of the day.

Delta: Delta represents the probability of the LTP not becoming zero at expiry. For example, if the Delta is 0.7864, multiply it by 100% to get 78.64%. This represents the probability that the LTP of that strike price will not become zero on the expiry day.

Delta also describes the rate of change in the LTP with a one-point movement in the underlying asset’s price. Delta varies by strike price, meaning each strike has its own Delta. As you move further ITM, Delta increases, and it decreases as you move OTM. In simple terms, a higher LTP has a higher Delta, and a lower LTP has a lower Delta.

Option buyers should always prefer a higher Delta. A Delta above 0.6 is best for option buyers. Always remember, the LTP of any strike price consists of both time value and intrinsic value. When you choose a strike price with a higher Delta, it automatically means you are choosing a strike with lower Theta—both are inversely proportional. This increases the probability of profit and maximizes your gains.

Gamma: Gamma measures the rate of change in Delta with a one-point movement in the underlying asset. Essentially, it shows how much Delta will change if the market moves by 1 point. You can say Gamma is the Delta of Delta.

Implied Volatility (IV): IV indicates the volatility in the particular stock or Index. IV directly affects the extrinsic value of the LTP. Higher IV means a higher time value, while lower IV means a lower time value. Planned news events tend to increase IV. Higher IV indicates that some news is active in the market.

Conclusion

In this chapter of the LTP Calculator free course, we learned about the Greeks and their role in options trading. Whether you are an options writer or an options buyer, you must pay attention to the Greeks, especially IV — while trading.

For an options buyer, Delta and IV are important. Delta should always be high, and IV should be low, and both of these conditions are favourable for buyers.

For an options seller, Theta should be high, Delta should be low, and IV should be high. These are the conditions favourable to writers.

So, keep learning the stock market with LTP Calculator, and believe me, one day you’ll also say, It’s a Baccho ka Khel.