BASICS OF FUTURES AND OPTIONS

This is the first chapter of the LTP Calculator Free Course, and this course is completely focused on the option chain and the LTP Calculator. In this course, we will learn how to read the option chain and how to use the LTP Calculator. So, before learning that, we must learn the basics of the Futures and Options segment in the Indian stock market. Let’s start learning.

Lesson Highlights

What is Futures and Options?

Trading in stocks typically allows only bullish trades, meaning you can only buy shares as a new position and hold them for as long as you wish. To sell a stock, you must already own the shares in your demat account. In other words, you can only sell to close an existing position. For example, if you own 100 shares of a stock in your demat account and want to sell them, you can only sell those 100 shares that you already own.

However, Futures and Options (F&O) offer greater flexibility to the traders by allowing them to both buy and sell stocks as new positions, but with a limited holding period.

- For example, if you don’t own the shares in your demat account but believe that the stock price will fall, you can still sell the stock. This is known as short selling. You are essentially betting that the stock’s price will decrease, and if it does, you can buy it back at a lower price to make a profit. In simple terms, you first initiate the trade by selling and then square off the position by buying it. This is only possible in Futures and Options.

- F&O trading provides traders with more opportunities to profit in both rising and falling markets, unlike regular stock trading in cash, which only allows you to profit from price increases. However, F&O trading involves a higher level of risk and it is also complex compared to cash trading.

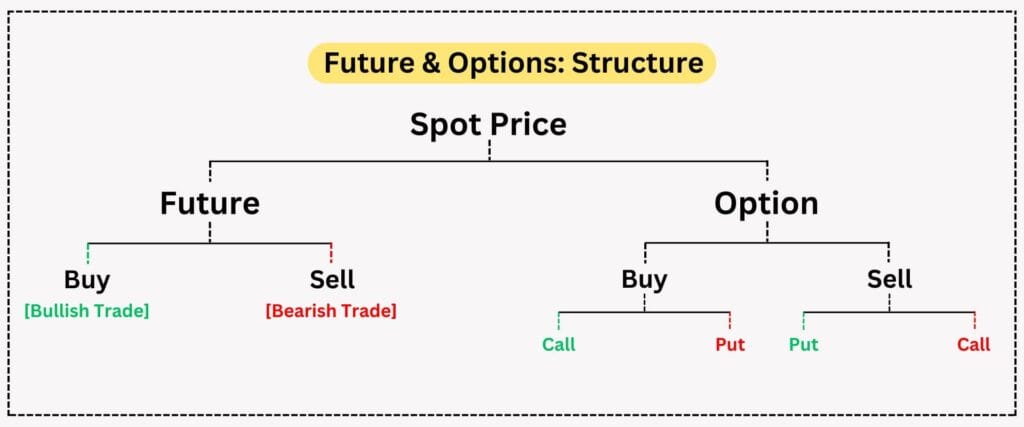

In the above illustration, you can see the structure of the Futures and Options (F&O) segment in the Indian stock market. Futures and Options are also called derivatives because their value depends on the value of an underlying asset, such as stock or index. Futures and Options are two distinct segments and we will understand each of them in depth.

Trading in Futures

When you trade in Futures and Options, you’re actually trading a contract for a particular stock. Unlike buying and selling actual shares, in F&O, you’re entering into an agreement to buy or sell the stock at a set price on a future date.

- The maximum validity for a contract is typically 3 months. After that period, the contract expires, and you must either settle it or roll it over into a new contract.

- In the F&O segment, you have to trade in bundles of shares, each bundle of shares is called as Lot. The lot size (number of shares in a bundle) for each stock varies, and you would be buying or selling in multiples of that lot size.

- There is always a difference between the futures price and the spot price of any particular stock or index. This difference keeps changing with every tick in the market. It can increase or decrease depending on market sentiments. Generally, the futures price is higher than the spot price, but sometimes, due to market volatility or sentiment, the futures price may be lower than the spot price. Gradually, as days pass and expiry comes closer, this difference also decreases, and on the day of expiry, both prices become equal by the end of the session.

Trading in Options

Trading in options is more complicated compared to Futures. Trading in options will introduce you with two new terms – Put (also called PE) and Call (also called CE).

In options trading, there are two types of traders: option buyer and option seller. Option Seller are also called the Writers. Writers refers to someone who takes a selling position before buying it. In other words, to square off their trade, they need to place a buy order.

In options trading, there is an agreement between the buyer and the seller, and that agreement acts as the rules for options trading. Let’s understand these rules to understand options trading.

Agreement between Buyer and Seller

When a buyer trades in options, he needs to pay a premium (LTP) for the particular strike price to the writers and enter into an agreement. According to the agreement, the writer promises the following to the buyers –

- The buyer has limited risk and the potential for unlimited profit.

- The seller has limited profit and the potential for unlimited risk.

- It is the seller’s promise that the premium can be minimum 0 and cannot go negative.

- It is also the seller’s promise that he will pay the difference between the strike price and the market price (Intrinsic Value) if it is positive, on the day of expiry.

These four terms in the agreement are the rules for options trading in the Indian stock market.

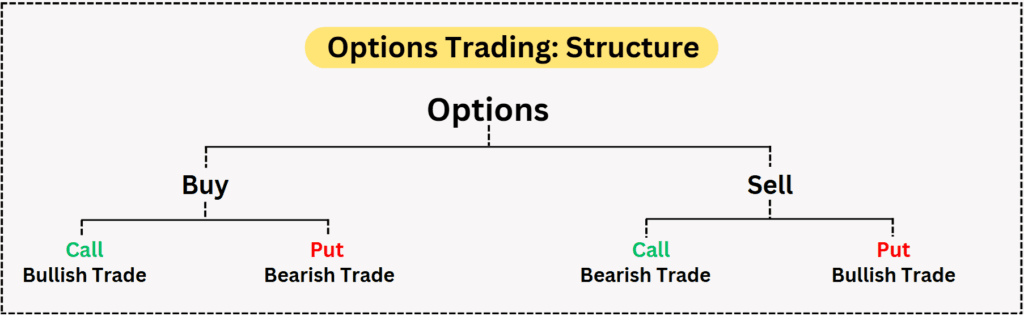

Concept of Call and Put

Bullish: When you believe that a stock or index is going to be bullish, you can either buy a call option or sell a put option. If you choose to buy the call option, you need a smaller amount of capital, whereas if you choose to sell the put option, you need a significantly larger amount of capital. This difference highlights how writing (selling) options is riskier than buying them.

Bearish: When you believe that a stock or index is going to be bearish, you can either buy a put option or sell a call option. If you choose to buy the put option, you need a smaller amount of capital, whereas if you choose to sell the call option, you need a significantly larger amount of capital. This difference highlights how writing (selling) options is riskier than buying them.

Need for Futures & Options

From a long time ago, long-term investment has been popular. The number of investors is greater than that of traders. However, short-term market volatility is a major issue for long-term investors. Let’s understand this with a practical example –

SITUATION 01

Person A currently holds 2,000 shares of SBI, purchased at a price of ₹610 per share. The current price of SBI shares is approximately ₹800, putting Person A in a significant profit position. Person A intends to keep SBI in their portfolio for the long term, and their analysis predicts that SBI will reach 1000 within six months. However, he receives a tip or news suggesting that SBI’s price may drop to around ₹700 this month.

Now, Person A faces a dilemma. On one hand, he is in a profitable position, but on the other hand, he is also uncertain about SBI’s short-term performance. If he sells the SBI shares now to secure their profit and SBI continues to rise, they might regret missing out on potential gains. Conversely, if he holds onto the shares and SBI’s price falls to ₹700 as predicted, he might regret not selling earlier to avoid losses. This scenario illustrates the common dilemma that investors face when managing their positions amid uncertain market conditions.

SITUATION 02

As a solution to this dilemma, Futures and Options (F&O) were introduced. F&O provides the facility to insure holdings within a portfolio. Let’s suppose Person A is aware of and knowledgeable about F&O. To mitigate the risk, Person A buys a put option for ₹20,000 as a form of insurance.

Now, let’s analyze two possible outcomes:

If the market actually falls and reaches around ₹700:

At this point, Person A would face a significant loss on their SBI shares. However, this loss would be managed by the profit gained from the put option. Additionally, the lower share price would present an opportunity for Person A to purchase more shares of SBI, if they are able to do so.If the news turns out to be false and SBI shows a bullish rally, reaching ₹900:

In this case, Person A would remain in a profitable position. The put option (acting as insurance) would expire worthless, but it effectively enabled Person A to hold their shares without the fear of significant losses during a downturn.

In both scenarios, Person A benefits from a win-win situation. The use of Futures and Options allowed them to protect against significant losses while still participating in potential market gains.

Conclusion

In this chapter, we learned the basics of futures and options in the Indian stock market. We also learned the need for futures and options. My motive with this chapter was to teach you the fundamentals of options trading so that you can easily understand the concepts covered in the upcoming chapters.