SIX KINDS OF REVERSAL THEORY

In previous chapters, we learned the concept of support and resistance on the LTP Calculator. In this chapter, we will learn about the Six Kinds of Reversal theory in the stock market. This theory involves the concepts of extensions and diversions on the LTP Calculator. This is one of the unique theories in the stock market given by our mentor, Dr. Vinay Prakash Tiwari. Let’s start learning.

Lesson Highlights

Six Kinds of Reversal

In the previous lessons, we learned about Support and Resistance. However, the concept of support and resistance is very old and has become quite popular among traders. That’s why the market doesn’t always reverse exactly from the support and resistance levels; instead, it often reverses from their extensions. What these extensions are will be discussed in this lesson. There are also some levels between support and resistance, which are called as Diversions. What these diversions are will also be discussed in this lesson. There are Six Kinds of Reversals –

- Resistance

- Extension of Resistance

- Support

- Extension of Support

- Diversion

- End of Diversion

What is Resistance?

As we have already learned, starting from the pair of imaginary line strike prices and moving towards the OTM Strike Prices, the highest volume or highest open interest, whichever is closest to the imaginary line on the call side, is called resistance.

But the market doesn’t reverse exactly from the resistance; it often extends few extra points above the resistance, and this extended level of resistance is called the Extension of Resistance. You can find this precise value on the LTP Calculator by clicking on the volume of the strike price at which resistance exists.

What is Support?

As we have already learned, starting from the pair of imaginary line strike prices and moving towards the OTM Strike Prices, the highest volume or highest open interest, whichever is closest to the imaginary line on the put side, is called support.

But the market doesn’t reverse exactly from the support; it often extends few extra points below the support, and this extended level of support is called the Extension of Support. You can find this precise value on the LTP Calculator by clicking on the volume of the strike price at which support exists.

What is Diversion?

The market always moves with a motive. Its motive is support and resistance. The market moves from support to resistance and from resistance to support. When the market moves toward its motive (from support to resistance or vice versa), it faces hurdles in the way. These hurdles are called diversions.

Diversions always act as a mini support or resistance because they don’t have the capacity to reverse the market like support and resistance do, but they can divert the market from its motive for a short while. Diversions are levels where we should consider booking profits. Each diversion has an End of Diversion, i.e. the level from where the market continues its move towards the motive

- If the market’s motive is from support to resistance (Bullish), then the call side will act as the diversions, and the put side will be the End of Diversions.

- If the market’s motive is from resistance to support (Bearish), then the put side will act be the diversions, and the call side will be the End of Diversions.

- To find the Diversion or End of Diversion, click on the volume of the strike price where there is a Diversion or End of Diversion.

Three Rules of Diversion

First Rule: The diversion is always one more than the total number of strike prices between support and resistance.

For example, in the image below, we can see that support is at 17600 and resistance is at 17700. Between support and resistance, there is only one strike price. As we learned, the number of diversions is equal to the number of strike prices plus one. Therefore, the number of diversions is 2.

Second Rule: If there are no strike prices between support and resistance, then there is only one diversion.

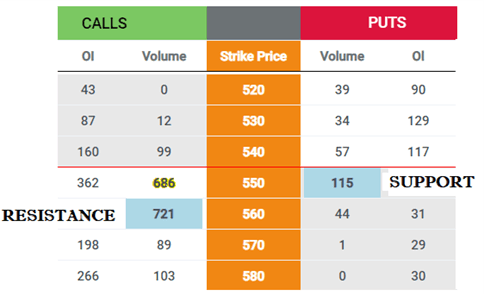

For example, in the image below, we can see that support is at 550 and resistance is at 560. Between support and resistance, there is only no strike price. As we learned, the number of diversions is equal to the number of strike prices plus one. Therefore, the number of diversions is 1.

Third Rule: If support and resistance are at the same strike price, there will be no diversion; i.e., the market will trade from extension to extension.

For example, in the image below, we can see that support is at 41500 and resistance is also at 41500. Between support and resistance, there is no difference in the strike price. In fact, both are at the same strike price. When both support and resistance are at the same strike price, there will be no diversion.

Conclusion

In this chapter of LTP Calculator free course, we learned the theory of six kinds of reversal, which includes the concept of Extension of Support and Extension of Resistance, as well as the concepts of Diversion and End of Diversion. When the market is at the extension of resistance, we take bearish trades, and when the market is at the extension of support, we can take bullish trades. Diversions are for profit booking in our trades, and the end of diversion signals the initiation of a new trade. In the upcoming chapters, we will learn the Chart of Accuracy 1.0 and there we will use these terms.

So, keep learning the stock market with LTP Calculator, and believe me, one day you’ll also say, It’s a Baccho ka Khel.