WEEKLY RANGE ON LTP CALCULATOR

In last chapter, we learned the theory of chart of accuracy 2.0 and its nine scenarios. In this chapter, we are going to learn the weekly range theory given by our mentor Dr. Vinay Prakash Tiwari. Let’s start learning.

Lesson Highlights

Weekly Range on LTP Calculator

Weekly Range refers to the range within which the market is expected to close on the weekly expiry. This weekly range theory is applied only to indices that have a weekly expiry, for example, NIFTY 50. Many traders use multiple methods to calculate the weekly range. Some use India VIX and apply a formula to it to calculate the range. In fact, this is a lengthy and complicated process. However, in this LTP Calculator free course, we will learn how to calculate the weekly range using the LTP Calculator.

On the AI LTP Calculator, we have three levels of weekly range: L1, L2, and L3. These weekly ranges are most useful for option writers. The L1 range is risky to trade, and the market can move beyond this range. The L2 range is moderate to trade, and generally, the market does not move beyond this range. The L3 weekly range is generally safe to trade, as there is a very low probability of the market breaking this range. Let us understand how to calculate these weekly ranges.

Calculation of L1 Weekly Range

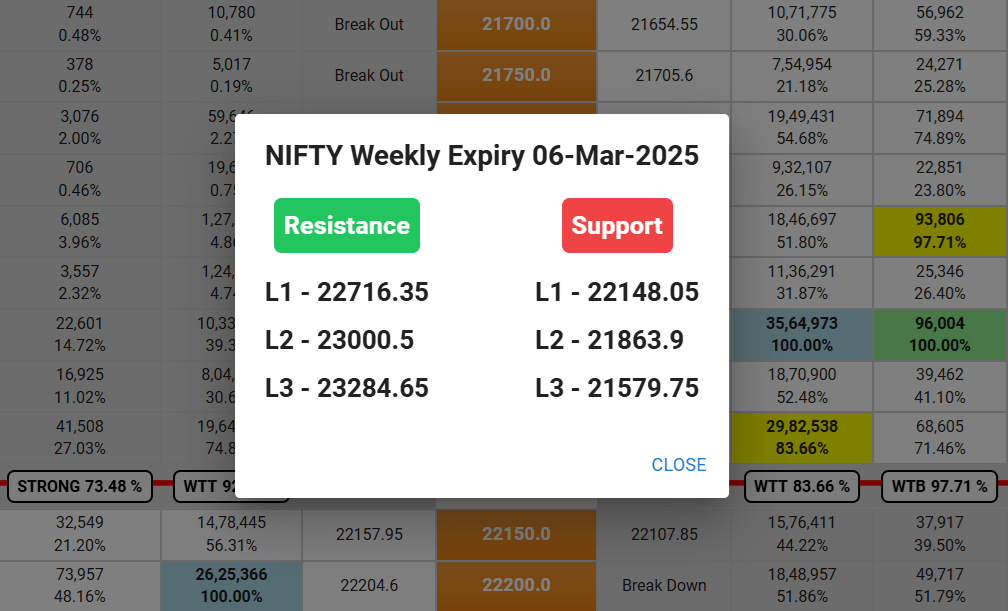

In the above image, we can see the weekly range of NIFTY for weekly expiry on 6th March 2025. How were these values calculated? Let’s understand.

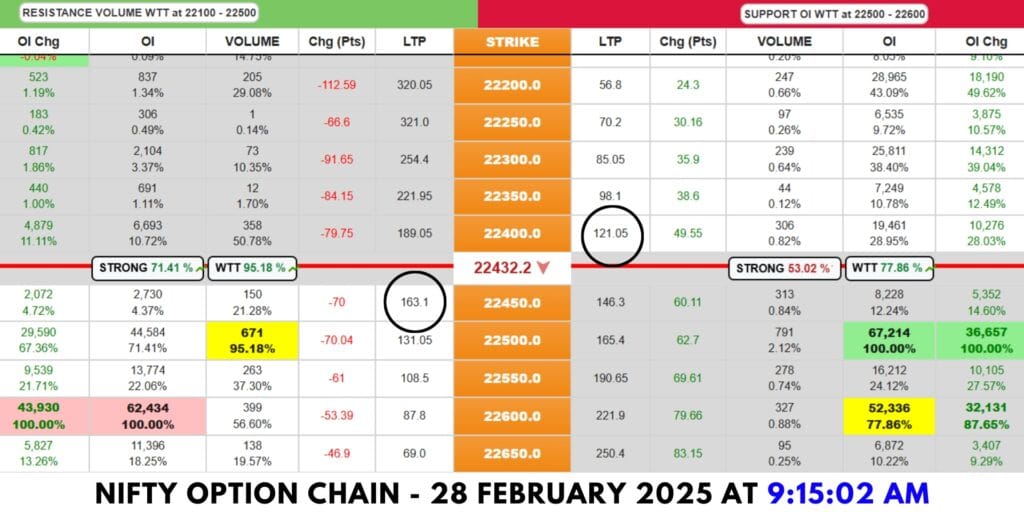

STEP 01: On the first day of the weekly expiry at 9:15 AM, open the option chain of current weekly expiry. Let’s assume that the current weekly expiry of NIFTY50 is on 6th March 2025; then the first trading day of the current week will be 28th February 2025.

STEP 02: At 9:15 AM, note down the current market price, the first OTM LTP on the call side, and the first OTM LTP on the put side. In the above image, CMP is 23432.20 and the OTM LTP in call side is 163.10 and the OTM LTP in put side is 121.05.

STEP 03: Add both the OTM LTPs (163.10 + 121.05) and the result will be 284.15. This value will be used in the calculation of L1 weekly range as well as L2 and L3.

STEP 04: To calculate the support in L1 weekly range, we need to subtract the current market price with the sum of call and put OTM LTP.

L1 WEEKLY RANGE SUPPORT: 22432.20 – 284.15 = 22148.05

STEP 05: To calculate the resistance in L1 weekly range, we need to add the current market price with the sum of call and put OTM LTP.

L1 WEEKLY RANGE RESISTANCE: 22432.20 + 284.15 = 22716.35

So, our L1 weekly range is 22148 to 22716. This means that on the day of expiry, NIFTY may close below 22716 and above 22148 i.e., somewhere between 22,716 and 22,148.

Calculation of L2 Weekly Range

Now, we have the L1 Weekly Range, so it became easy to get the L2 Weekly Range. We just need the L1 Range and the sum of OTM LTPs, which is 284.15. Let’s calculate the L2 weekly range.

STEP 01: To calculate the support of L2 Weekly Range, subtract the sum of OTM LTPs from the support of L1 Weekly Range.

L2 WEEKLY RANGE SUPPORT: 22148.05 – 284.15 = 21863.90

STEP 02: To calculate the resistance of L2 Weekly Range, add the sum of OTM LTPs with the resistance of L1 Weekly Range.

L2 WEEKLY RANGE RESISTANCE: 22716.35 + 284.15 = 23000.50

So, our L2 weekly range is 21863 to 23000. This means that on the day of expiry, NIFTY may close below 23000 and above 21863, i.e., somewhere between 23,000 and 21,863.

Calculation of L3 Weekly Range

Now, we have the L2 Weekly Range, so it became easy to get the L3 Weekly Range. We just need the L2 Range and the sum of OTM LTPs, which is 284.15. Let’s calculate the L3 weekly range.

STEP 01: To calculate the support of L3 Weekly Range, subtract the sum of OTM LTPs from the support of L2 Weekly Range.

L3 WEEKLY RANGE SUPPORT: 21863.90 – 284.15 = 21579.75

STEP 02: To calculate the resistance of L3 Weekly Range, add the sum of OTM LTPs with the resistance of L2 Weekly Range.

L3 WEEKLY RANGE RESISTANCE: 23000.50 + 284.15 = 23284.65

So, our L3 weekly range is 21580 to 23285. This means that on the day of expiry, NIFTY may close below 23285 and above 21580, i.e., somewhere between 23285 and 21580.

Option Writing with Weekly Range

As we have already learned, the weekly range represents the range within which Nifty 50 can close on the day of expiry. This means that all the strike prices on the call side above the upper range can become zero on expiry day, and all the strike prices on the put side below the lower range will become zero on expiry day. Thus, writing option contracts outside the weekly range can be profitable with lower risk.

Best strategy for option writing to achieve higher profits with lower risk?

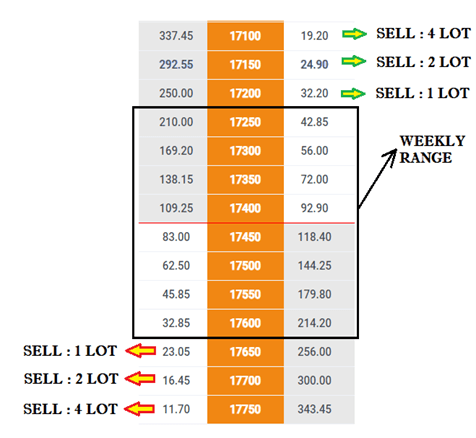

After calculating the weekly range, we can sell strike prices outside the weekly range for option writing. Let suppose that our weekly range is 17235 – 17589.

Always write in hedged positions, i.e., sell both Put and Call options at the same time.

Based on the weekly range: market top is 17589, so sell the 17650 and above strike prices on the Call side and market bottom is 17235, so sell the 17200 and below strike prices on the Put side.

To prefer a safer approach in writing, begin selling strike prices outside the weekly range in increasing quantities. Start with one lot in a hedged position and continue to increase the quantity as far as possible toward the OTM strike prices, based on your risk capacity.

If a stop-loss is required, you can add the call side LTP and put side LTP and that sum of both LTPs will be your stoploss.

-

For example, the 17650 strike on the Call side is the first strike price outside the weekly range, and the 17200 strike on the Put side is the first strike price outside the weekly range. You should sell them with 1 lot each. The sum of the LTP of the 17650 CE and 17200 PE will be your stop-loss. If either side hits the stop-loss, book the loss in that side and keep the opposite side trade as it is; it will automatically become zero on the expiry day. It is very rare for the market to hit the stop-loss on both sides.

-

For example, the 17700 strike on the Call side is the second strike price outside the weekly range, and the 17150 strike on the Put side is the second strike price outside the weekly range. Your stop-loss will be the sum of the LTP of the 17700 CE and 17150 PE. If either side hits the stop-loss, book the loss and keep the opposite side trade as it is; it will automatically become zero on the expiry day.

-

For example, the 17750 strike on the Call side is the third strike price outside the weekly range, and the 17100 strike on the Put side is the third strike price outside the weekly range. Your stop-loss will be the sum of the LTP of the 17750 CE and 17100 PE. If either side hits the stop-loss, book the loss and keep the opposite side trade as it is; it will automatically become zero on the expiry day.

-

Always number the strike prices outside the weekly range in call side and put side and on the basis of that numbering double the quantity of your trade. This will reduce your risk and increase your profit.

Conclusion

In this chapter, we learned the concept of the Weekly Range on the LTP Calculator and also the methods of trading with the Weekly Range. The Weekly Range is mainly for option writers, but sometimes it also helps option buyers to enter into trades at the top or the bottom of the market and make profits. Option writing has always been very risky and also requires a lot of funds, so we need to carefully analyze the market and then initiate the trade according to our risk capacity.

So, keep learning the stock market with LTP Calculator, and believe me, one day you’ll also say, It’s a Baccho ka Khel.